The Gig Economy and Taxes in Canada: What You Need to Know

- 20 Sep, 2025

Taxes in the Canadian Gig Economy

As the gig economy continues to grow in Canada, thousands of freelancers and independent workers are navigating self-employment tax obligations for the first time. Whether you’re tutoring online, delivering groceries, or designing websites, tax compliance is essential.

This guide explains what gig workers need to know about taxes in Canada for 2025—including income reporting, deductions, GST/HST, and common CRA pitfalls.

Do Gig Workers Need to Pay Taxes?

Yes. If you earn more than CAD $500 annually from self-employment, you’re required to report it to the Canada Revenue Agency (CRA).

Even part-time or occasional income (e.g., pet sitting or weekend design gigs) must be declared.

What Counts as Gig Income?

- Freelance service payments (design, writing, consulting, etc.)

- Delivery platform earnings (Uber Eats, DoorDash, Instacart)

- Online sales and marketplaces (Etsy, Fiverr)

- Tutoring or coaching income

Tip: Keep separate records for each income stream, even if paid through the same platform.

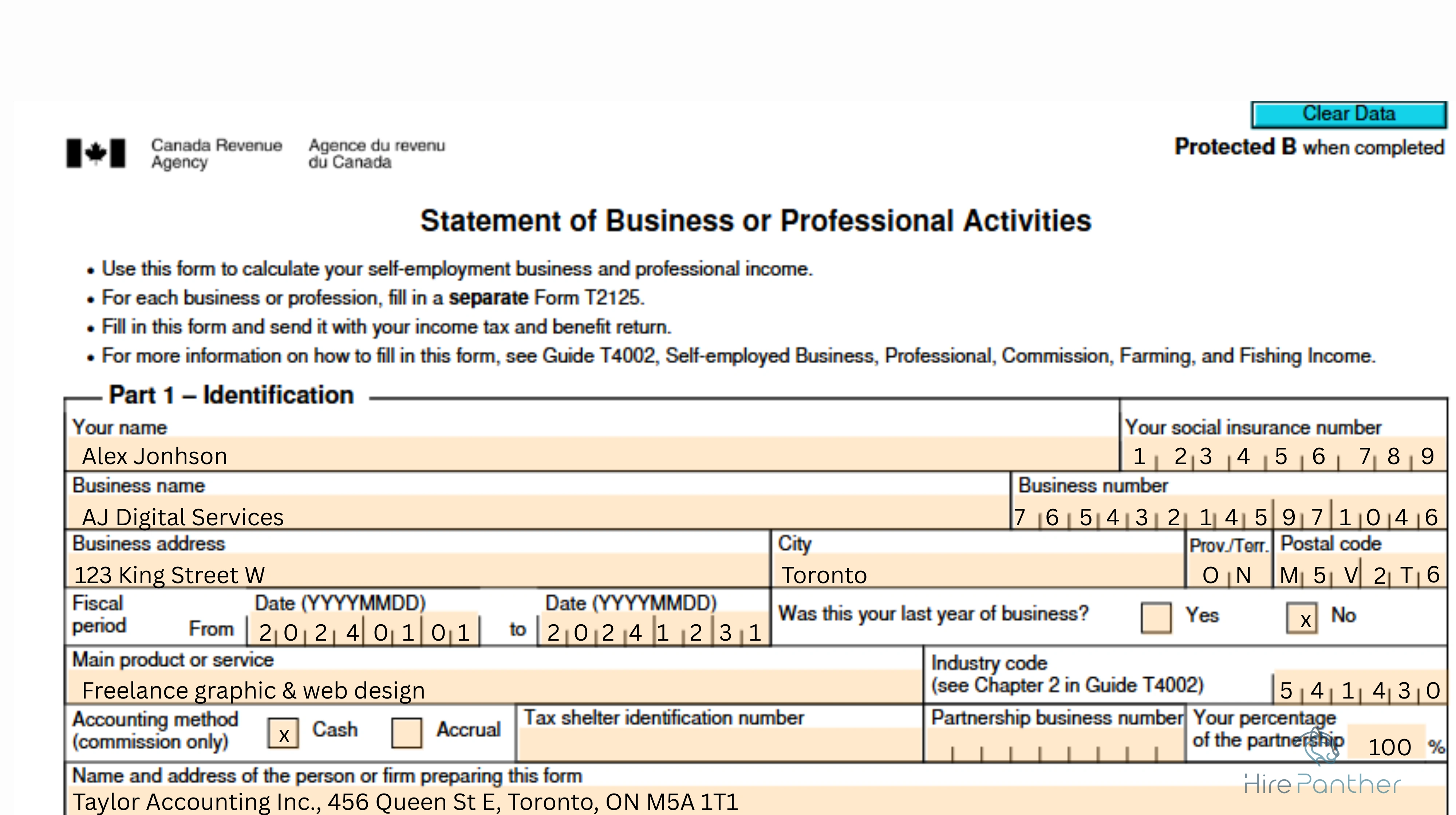

Tax Forms You’ll Use

- T2125: Statement of Business or Professional Activities

- T1 Personal Tax Return: Main filing form

- GST/HST return (if applicable): Required if earnings exceed $30,000/year

Key Tax Deductions for Gig Workers

You can deduct legitimate business expenses that help you earn income. Common write-offs include:

- Home office expenses (internet, utilities, rent portion)

- Phone and software subscriptions

- Equipment and supplies

- Business travel or mileage

- Marketing and website costs

Tip: Keep digital and physical receipts—CRA may request proof during an audit.

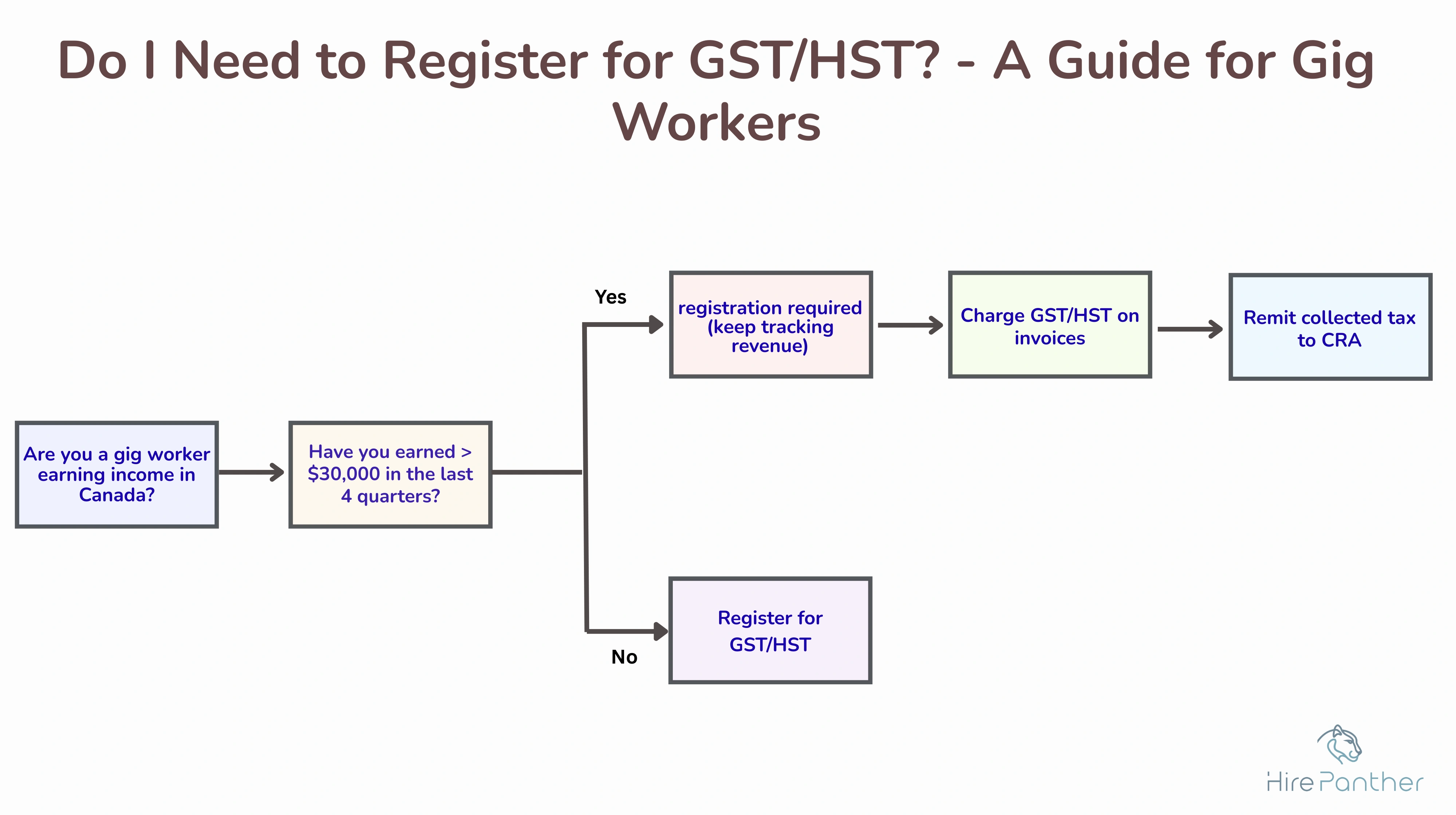

Do I Need to Register for GST/HST?

If you earn over CAD $30,000 in the last four consecutive calendar quarters, you must:

- Register for a GST/HST number via CRA’s Business Registration portal

- Include GST/HST in invoices and remit collected taxes to CRA

How to Keep Records

Maintain organized records of:

- Income (platform payouts, invoices)

- Expenses (categorized by type)

- CRA correspondence and tax returns

Apps like Wave, QuickBooks, or Excel spreadsheets can simplify tracking.

Common Mistakes to Avoid

- Underreporting income from digital platforms

- Forgetting to remit collected GST/HST

- Claiming personal expenses as business ones

- Missing quarterly instalment payments (if required)

Do I Need to Make Instalment Payments?

If your tax bill exceeds $3,000 in the previous year, you may be required to pay quarterly tax instalments. CRA will notify you.

Dates:

- March 15

- June 15

- September 15

- December 15

Getting Help

- Hire a tax professional if you’re unsure about deductions, GST, or multi-source income.

- Use CRA’s free resources or call their help line for general questions.

Conclusion: Stay Ahead of Tax Season

Understanding your tax obligations as a gig worker ensures financial stability, avoids penalties, and strengthens your long-term career. Whether you’re side hustling or freelancing full-time, treat your income like a business from day one.